Find below my review of Winding Tree as an sample on why Cryptocurrencies face major hurdles in the travel space….

One would we hard-pressed these days to avoid the ongoing craze about Blockchain technology and its application for the travel industry: “Ethereum”, “Coin offerings”, “Wei gas”, “Smart Contracts” and surely soon enough “Winding Tree” are buzz words which get picked up and analyzed by the leading travel media outlets.

One would we hard-pressed these days to avoid the ongoing craze about Blockchain technology and its application for the travel industry: “Ethereum”, “Coin offerings”, “Wei gas”, “Smart Contracts” and surely soon enough “Winding Tree” are buzz words which get picked up and analyzed by the leading travel media outlets.

As a technology geek myself (and as part of my upcoming Master thesis) naturally great curiosity has been sparked on how Blockchain technology can be a game changer by creating de-centralized market places and thus having the potential of turning the traditional order of things in the travel industry around. But the commercial side of me also has questions whether such new systems, like Winding Tree, can Blockchain be a true replacement to the current state of things?

Granted, there is a lot of legacy in this industry, but one should not forget that this industry still moves millions of people around the globe and has spent years and years trying to perfect and improve the systems surrounding this so travelers can get from A to B as effortless and safe as possible.

Nontheless, things are changing.

Bitcoin, a digital currency that was only a few years ago laughed at as a pipe dream of computer geeks, has had an amazing ride in terms of evaluation in the last year(s) and the next generation is already going every crazier: Ethereum, which is like Bitcoin with added conditions on when the “Bitcoin” is paid (Smart Contracts), has lead to a myriad of startups who are trying to build decentralized networks, in which all kinds of goods can be automatically traded and records automatically kept and locked into the system for good.

The travel industry obviously sounds like a very sexy target for such an application: here different fulfillment partners might need to work hand-in-hand together and a myriad of data-points would be available which could be connected as a chain. Think of a traveler getting into a Taxi to go to the airport, checking-in at the desk or via his phone (or online before), dropping his bags at the drop-off, have the flight gate tracked on his app, get special offers once inside the terminal, board the plane and have his favorite movies/newspapers ready for him…and that all in one secure cryptochain which could be part of the journey until the traveler arrives in his room.

This vision might be a bit far off still but the world is getting closer: I personally witnessed some great stuff from the travel giant Amadeus at their recent Amadeus Hotel Exchange conference on how many serious applications are already are possible… (see image on the left)

Also TUIs Blockchain applications are getting some widespread attention (I personally think that this is rather came to live to tackle their internal issues with a lot of separate business units and different systems and a new technology helping to unify that) and Nordic Choice Hotels also has a pilot for testing Blockchain for distribution.

This then is a great introduction for the main topic of this post: Winding Tree, the Blockchain startup on travel.

A closer look at Winding Tree

I stumbled across Winding Tree when researching for my master thesis and was immediately intrigued. Upon reviewing their whitepaper, blog posts and videos that initial excitement was more converted into curiosity whether the technology could hold its promise in real life business situations too. After a bit back and forth the Winding Tree team on their Telegram channel I decided then to compile my thoughts into this blog post (as this is also was asked by the Winding Tree team).

So find below then what possible weaknesses I have identified when thinking of bringing Winding Tree into todays real travel tech world…

Issue 1: Easily possible “fake hotel” scam

Any anonymous system without a centralized control always seems to have the issue that it attracts scamers. The case of fake hotels is not a unknown one in the online travel industry: someone sets up a fake property, takes pre-payments and when the travelers arrive, there actually is no hotel. Now, this is more of an “ancient” problem and today there are more sophisticated credit card scams going on, but with Winding Tree this might become right a blast of the past coming back to haunt online travel again…

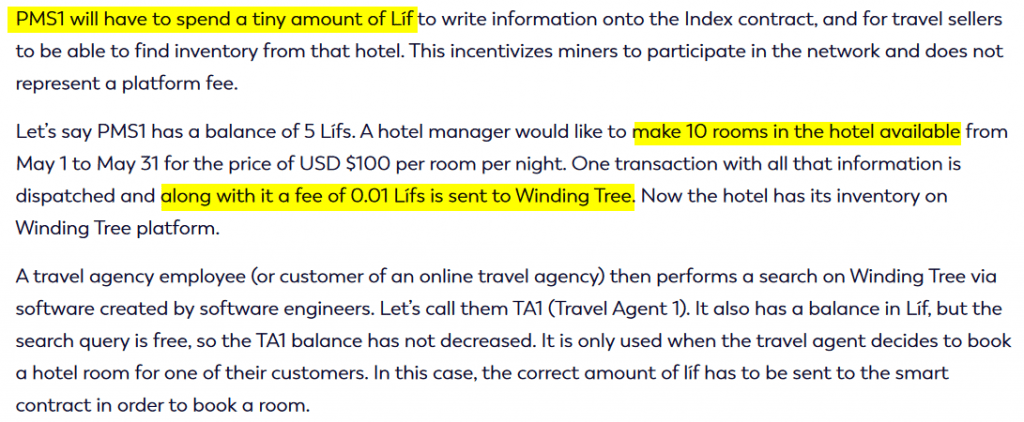

And it theoretically such as scam would not be so hard to setup on Winding Tree:

- Scammers would analyze compressed market situations (like large fairs, festivals etc) where there it is certain that rooms will be expensive, scarce and in certainly in high-demand

- One could simply register a “fake” hotel via the Winding Tree “createHotel” function (or there would be an even easier way to get real hotels, which are not open for business, but I will not elaborate on that…)

- Then add some amazing last-minute rates, pre-pay and Liv-payment only (Liv = Winding Tree’s currency, based on Ethereum – for non-tech-people: kind of their version of Bitcoin, bound to the Winding tree platform)

- Get all the bookings, take the crypto, push it on through other channels….puff! Travelers money gone and (almost certain) no way to get it back…

A counter-argument here made was “then just set it in the Smart Contract that payment is only set once the service has been rendered“. Well, that is a nice idea, but what would here be the reverse scenario? That travelers could then decide whether to pay or not to pay? Probably in combination of the hotel taking a credit card to secure the booking this even might be possible – but what happens in a case of a dispute? The traveler would not pay the Lif, the hotel would charge the card, that charge would go back as a “chargeback”…another can of worms opened.

Plus that scenario only applies to the hotel-side of things, a fake hotel could still ask for money upfront and traveler thus still fall victim to that.

Another idea to clear this would be to include “clearing houses” for the transactions (like the IATA one). That surely is a good idea, but what if the hotel was just setup the night before arrival and all of the last-minute bookings still fall victim to a scam? Would clearing houses work over night…? What kind of cost would be associated with that? Would a clearing house insure the risk? etc etc

Thus: one box of the Pandora here opens up another one. Granted, Winding Tree is not live yet, but a quick look at their code might have shown a major first hole here…?

Issue 2: Currency fluctuation (big!!)

This probably IMHO is the biggest riddles that needs answering. One of the biggest friction points in travel is who pays what to whom and when under which currency. In the B2B world of travel this game is also known as “Who is the bank…?“.

Imagine the following scenario: A traveler books his summer vacation after coming back from his Christmas break in order to get a nice deal on a great location somewhere around the planet. Thus its very likely that the time-span between when he made the booking and the actual day of checkout could be, as an example, 180 days here.

A lot can happen in 180 days. A hurricane could destroy the hotel. The airline booked could go bankrupt. But even more simple (and not so dramatic) the currency the traveler has booked his vacation in might change in value. For most parts, anyone who books either in EUR or USD probably will not see more then a 10% difference, up or down (unless Mr Trump really tries to play with the “big button” of his…).

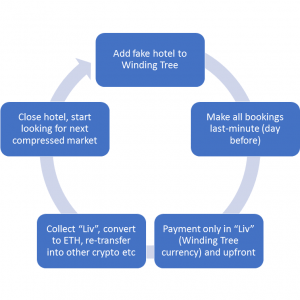

But cryptocurrencies are different. The market is fluctuating and the next wave of Blockchain startups have very often in common that you can trade in your EUR/USD/local currency into Ether (ETH), the currency of the below lying tech framework. Winding Tree is not any different here at their currency Liv trades in a 1:10 ratio to ETH (so 1 Liv is 0.1 ETH).

The makers of Winding Tree certainly vision a closed system, but that vision seems to be taken over by reality already: just checkout the myriad of requests of people on their channels asking what the “exchange rate to ETH is”. This also because there are known scams where you can put your money into a crypto currency but later on have no way to get it out or transfer it over (like OneCoin).

With the fixed exchange rate of Liv to ETH, a big question then is on how ETH changes in value over time. Or even more on how Liv will be traded across coin desks in those next 180 days. The following scenarios could apply:

- ETH continues on its meteoric rise and ten folds in business value. Thus the room rate that the traveler might have booked for 0.1 ETH, and paid to the hotel at time of booing to secure the transaction, would have a different value. For the hotel the 0.1 ETH today would be worth 101 EUR. However, in 180 days time the same room then would be worth that in ten-fold in EUR, so 1010 EUR which would amount into a massive profit for the hotel (and a major loss for the traveler in terms of opportunity cost of capital: if he booked last minute in a 180 days time his money then would have gotten him a much nicer room).By the way, this principle is also demonstrated by the many requests on WindingTrees open channel to get a better deal on their initial closed ICO since the public ICO date of WindingTree (and start of exchange to ETH) has been moved forward 2 months. ETH just has grown so much in value in the meantime that investors are definitely looking at their opportunity cost of capital here.

- Other scenario: the Ethereum bubble bursts because major players withdraw their investments and a following stampede sees the bubble burst an ETH is worth about 50% of what it was back on the day when the traveler booked.(I do not think that to be likely due to ETH being so broad….but hey, the dot.com bubble burst, so did the subprime loan bubble too, right? And both were build on the same principle). The traveler might grunt at the fact that his transferred in ETH might have halved in value, but he still has the room booked which is now half its price in regards to the value to EUR.But that also means that the hotel now has to accommodate the traveler at half the price compared to their regular rates they initially put this in (and its very likely that they would have based the Liv price against local currency when they created the rate, after all that is what they are paying their bills in, wages, rents etc). Here an argument can be made that the hotel should have known what it gets itself into and that Liv willl be a different currency with a much different risk (both positive and negative) that it should have considered. But that argument does not pay any bills nor wages, rents or the myriad of expenses that a hotel has to make in real, local currency.

So thus here I cannot see on how the makers of Winding Tree could solve this riddle when bookings are made in their currency (they also have capability to book in local currency – but trading of the crypto currency is one of the major cornerstone of such marketplaces to keep stability up; paying in local currency would just straightforward bypass this).

I personally think that here lies one of the biggest flaws in their design and even probably in crypto for travel in general.

Issue 3: File-size of dezentralized portfolio and traffic load

For the Winding Tree platform to become “the one and only” solution (or for peers participating) this might be a tech barrier that needs to be solved (based on tech bandwith/associated cost that is available today).

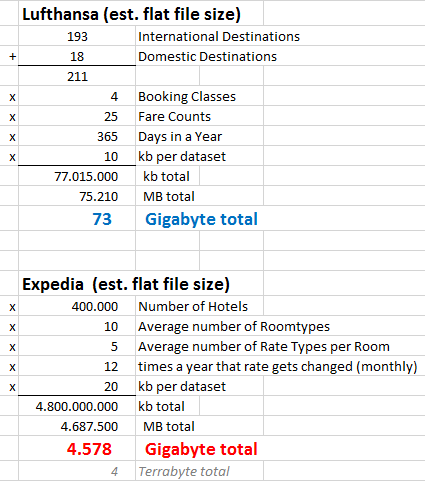

Thus: how much inventory can truly go onto the Winding Tree platform? I did a quick calculation (download here) to compare a possible inventory flat file for both Lufthansa and Expedia (which also could be Priceline or Hotelbeds, would not make a difference for the principle).

I think one quick glance should already show where the problem is:

- Airlines are easy to predict: there really only are 4 different seating classes, 25 fare types and airlines do not fly to every IATA-registered airport in this world…

- For hotels, that is a different game: in airline terms means that every airplane has completely different seating classes (=room types) and that the airline operates hundreds of thousands of different planes. What this comes down to is illustrated above (….come to think of it, as a business traveler I would love the idea to get a completely different plane every time 😉 😉

- File size for hotels would be measured in Terrabytes(!!) – even for todays cloud-based tech world that is quite something… (and above is Expedia only.. add to that Priceline , other suppliers, hotels directly and the file size gets gigantic)

- Cloud-based solutions are able to tackle that but the hosting cost would definitely need to be factored in

This is probably a solvable problem as its rather money related (on how much the hosting would cost) – but it sets up the much bigger problem below:

Issue 4: Transaction/network (update) speed + room availability

So now you gotten a terrabytes-size file sitting on your server/cloud as being the node – but that file will not be sitting still! A lot of the hotels will continue to use channel managers to put their inventory in all kinds of channels. Bookings will occur. Cancellations too. Rate and price changes, fully automated through channel manager systems. And it will all sum up to traffic. A LOT of traffic for updating the chain with availability, cancellations, bookings etc.

And then you will have some guys who will just hit the crap out of the decentralized system by hooking up every Meta website globally there is between Berlin and Bengalore, Tokio and Toronto, Rio and Rome. And there will be a lot of them as usually suppliers put a traffic cap on their partners to manage just such a load. (And no, we are not talking about querying the system, but just bookings, cancellations and modifications and the traffic that this generates).

So besides the framework itself being able to handle the transactions at that level (and I think Winding Tree gotten that one theoretically very well covered by using “State Channels”), you would have a ton of traffic which probably amounts to quite some server/cloud-based cost (yes, those guys just do not give out flat-rates, right? 😉

The next issue is that with such big file sizes, and so many updates on availability, there is a good question how good the overall availability of rooms via the flatfiles is (ask Traveltainment or Peakwork who are masters at this). Surely enough, one can always make an availability call to check whether the room is truly available, but that would mean an automated response from the hotel in question. Which in turn is going to get hit with a lot of those requests too (especially from our Meta friends). Thus managing the traffic levels of this live global system might be staggering. True, it might get better in the future but for now its definitely an issue.

Issue V: Supplier cost (Cancellations)

This is probably a smaller issue and really only comes down to funding – however, I would like to raise it as the cost of Priceline, Expedia and & Co also always get mentioned by the Winding Tree team as well as one of the “main negative points “of today’s travel environment.

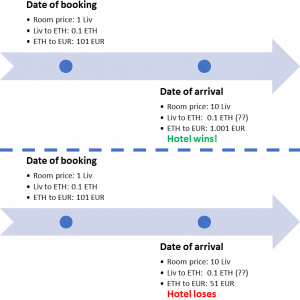

In Winding Tree’s whitepaper you can find an example on how this system would work for suppliers, see screenshot below:

So any supplier participating here will have to put Liv in to make this work. (the above example of LIV 0.01 would be about EUR 1.-). Does not sound that much, right? However, some questions remain:

So any supplier participating here will have to put Liv in to make this work. (the above example of LIV 0.01 would be about EUR 1.-). Does not sound that much, right? However, some questions remain:

- Cancellation rates of 15-30% is something considered normal within the travel industry – this means here that any supplier needs to factor in some sunk cost for room availability having been added to the Index but the booking has then be cancelled (hotels might just add this as a cancellation fee to the offering but that also can be a conversion killer)

- Unwanted group bookings (which usually get caught by OTAs) might drive that cancellation ratio even higher up as here agents tend to pre-block a allotment at the property upfront, cancellation rates here can be up to 60% – add more sunk cost!

- Hotels also would want to update room availability to the Index – if this done via Channels Managers a high number of automated changes might further reek up cost here too

Thus: initially this might look like a preferable model to today’s supplier models but the real cost can only be determined once the Winding Tree platform gets more widely adopted (and probably hotels need to learn on how to hedge Liv too)

Conclusion

Blockchain in travel might only be in its infancy but is certainly here to stay. Nonetheless, I would very much disagree with Winding Tree’s CEO Maksim Izmaylov that this should be primarily publicly used, I rather think the opposite will drive initial technology adoption.

Winding Tree labels itself to become a disrupter solution for the travel world and from a first glance this certainly looks intriguing (especially for airlines to have a decentralized distribution system: the interest of Lufthansa here after their public mud fight with the GDS world last year here is easily explained). But beyond the first look you can easily identify some big question-marks on how this Blockchain will work in the real time travel world and how flawed some of the basic design might be when trying to fit into todays travel business ecosphere.

Trial and error is always part of any new technology and sometimes it takes some steps in evolution before something is scalable – at the same time that natural tech evolution also weeds out any sytems that have flaws in basic design.

Will Winding tree then become that truly scalable Blockchain travel platform? Or will they be weeded out as many other already failing Blockchain startups as well?

What it all comes down to is that Winding Tree might not have or be the answer. Yet.

Add-on #1 (Jan 12th 2018) – “Fake airline”

I have received a question whether the “fake hotel” would also apply to a “fake airline” scenario. So in principle yes, one could always grab an unused IATA-Code and make something up here. Again, that would come down to Clearing Houses and then the question what would fund this, which Clearing House would take up the risk etc etc

Add-on #2 (Jan 15th 2018) – Other ICOs: “Travelchain” and “Bitair”

There are two more ICOs on travel which would probably suffer from same issues (and from a first view do even look more vague then Windingtree by not even having any partnerships announced): Travelchain and Bitair. On Travelchain you can see a lot of lofty promises in their whitepaper (and what my industry contacts tell me that the makers “are far from travel”) where as Bitair does not even deliver any further in-depth paperwork….

Add-on #3 (Jan 23rd 2018) – Issues with PCI compliance and data protection

Quite an interesting point was raised here on how Winding Tree might not be PCI-compliant (or Data Protecion Act compliant) when credit card/customer data is submitted – I actually would not think that it might be such an issue as one could encrypt numbers here, however, whether the PCI consortium would give its blessings is yet to be found out

Add-on #4 (Feb 6th 2018) – Blog response by Winding Tree’s CEO Maxim

So Maxim did finally respond here, but his answers rather seem to raise further questions and look like a P/R quick fix – but please go ahead and make up your on mind on his post and my response in the blogpost below

11 Comments

Maksim Izmaylov

seolobster

Rsr

seolobster

O Pan

seolobster

Lester

Mike Cartwright

seolobster

Nick

seolobster